st louis county sales tax 2021

Louis which may refer to a local government division. April 19 2022 Published Dates.

Louis County collects on average 125 of a propertys assessed fair market value as property tax.

. The local sales tax rate in st louis county is 2263 and the maximum rate including missouri and city sales taxes is 9988 as of november 2021. 29 2021 625000. This table lists each changed tax jurisdiction the amount of the change and the towns and.

Louis County Courthouse 100 North 5th. This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction.

October 2021 Auction Book. The St Louis County sales tax rate is 226. State Local Sales Tax Rates As of January 1 2021.

8 2021 725000 3635 Flad Av. County Tax City Tax Special Tax. The December 2020 total local sales tax rate was 7613.

California 1 Utah 125 and Virginia 1. Tax-forfeited land managed and offered for sale by St. Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes.

Louis County Division of Performance Management Budget 04142021. 11 2021 770000 33 Waterman Place. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

May 24 2022 - Sale 212. St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl Understanding The Missouri Supreme Court Ruling On Sales Taxes Ksdk Com 2022 Best Places To Live In St Louis County Mo Niche Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 154 And Get 33 Off Which Are The Most Dangerous Places In Saint Louis Quora. 4142021 102514 AM.

St Louis County Sales Tax 2021. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Wednesday July 01 2020.

Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. This table shows the total sales tax rates for all cities and towns in St. Are Dental Implants Tax Deductible In Ireland.

The Missouri state sales tax rate is currently 423. A City county and municipal rates vary. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The local sales tax rate in st louis county is 2263 and the maximum rate including missouri and city sales taxes is 9988 as of november 2021. Use this calculator to. General Median Sale Price Median Property Tax Sales Foreclosures.

Opry Mills Breakfast Restaurants. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. 012021 - 032021 - PDF.

B Three states levy mandatory statewide local add-on sales taxes at the state level. The Missouri state sales tax rate is currently 423. These rates are weighted by population to compute an average local tax rate.

Statewide salesuse tax rates for the period beginning January 2021. You can print a 9679 sales. The 2018 United States Supreme Court decision in South Dakota v.

Complete Policy Manual of the St. Majestic Life Church Service Times. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax.

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. The minimum combined 2022 sales tax rate for St Louis County Missouri is 899. Soldier For Life Fort Campbell.

Top Property Taxes ADAMS PL CONDO. NO LAND TAX SALE MAY 26 2022. Louis county is the largest county east of the mississippi river.

This is the total of state and county sales tax rates. The minnesota state sales tax rate is currently. Restaurants In Matthews Nc That Deliver.

The current total local sales tax rate in Saint Louis County MO is 7738. Louis County Collector of Revenues annual tax sale on Monday August 23 2021. November 2021 8.

Ad a tax advisor will answer you now. Always consult your local government tax offices for the latest official city county and state tax rates. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

ALL PROPERTIES HAVE BEEN SOLD. Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. The sales tax jurisdiction name is St.

Income Tax Rate Indonesia. April 5 2022 and April 12 2022. Interactive Tax Map Unlimited Use.

Due to the ongoing public health crisis the 2021 tax sale will be conducted via sealed bids only. 101 rows how 2021 sales taxes are calculated for zip code 63138. The latest sales tax rate for Saint Louis MO.

LOUIS COUNTY tax region see note above Month Combined Tax State Tax. In the circuit court of st. The 2018 United States Supreme Court decision in.

Land Tax sales this year are held 5 times a year in April May June July and August. Louis County Real Property Tax Sale On August 23 2021 Real estate properties with three or more years of delinquent taxes will be offered for auction at the St. Wednesday July 01.

Ad Lookup Sales Tax Rates For Free. The St Louis County sales tax rate is 0. Louis County Sales Tax is collected by the merchant on all qualifying sales made.

Due to the ongoing public health crisis the 2021 tax sale will be conducted via sealed bids only. Public Safety Sales Tax Quarterly Report 2021 Quarter 1 Beginning Balance 112021 17332761. May 10 2022 and May 17 2022.

This rate includes any state county city and local sales taxes. December 2021 8988. Louis Sales Tax is collected by the merchant on all qualifying sales made within St.

4200 Maryland Av Unit. This is the total of state and county sales tax rates. The Minnesota state sales tax rate is currently 688.

Prop P Quarterly Reportxlsx Author. The following rates apply to the ST. The St Louis County sales tax rate is 226.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is 738. Sales Dates for 2022 Sale 208.

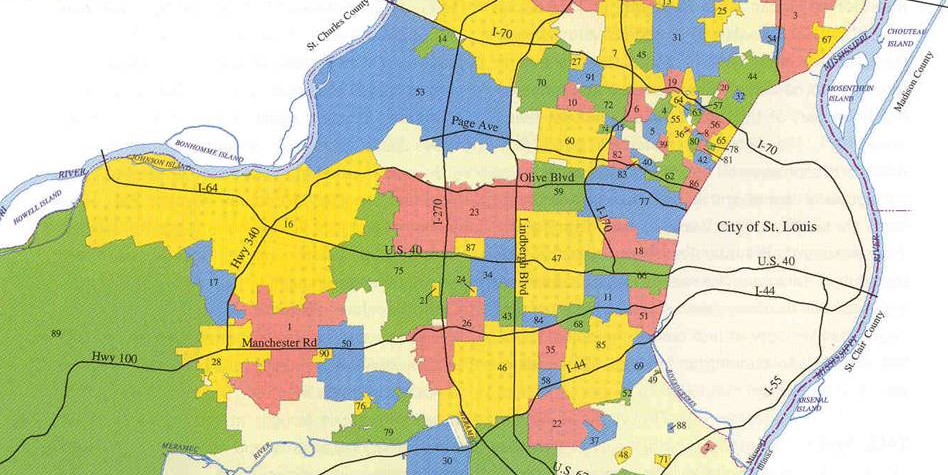

Action Plan For Walking And Biking St Louis County Website

2022 Best Places To Live In St Louis County Mo Niche

Print Tax Receipts St Louis County Website

Sheriff S Office St Louis County Courts

Housing Authority Of St Louis County Building Our Communities For Over Sixty Years

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

Summer Reading St Louis County Library

Let It Go Time To Disincorporate Municipalities In St Louis County Nextstl

Revenue St Louis County Website

Design A Bookmark Contest St Louis County Library

Revenue St Louis County Website

Greater St Louis Inc Shows Support For Missouri Small Businesses Backs St Louis County Proposition C Greaterstlinc

Online Payments And Forms St Louis County Website

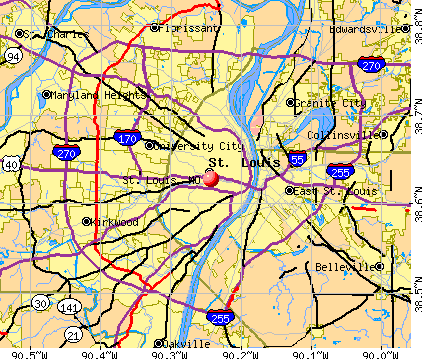

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Action Plan For Walking And Biking St Louis County Website

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide