dependent care fsa limit 2021

The 15500 is excluded from the employees gross income and wages because 10500 is excluded as 2021 benefits and the remaining 5000 is attributable to a carryover permitted under Sec. The new Dependent Care FSA annual limit for 2021 pretax contributions increases to 10500 up from 5000 for single.

Dependent Care Fsa Outdoor Activities For Kids Free Things To Do Kids Pictures

Typically the maximum age for a child to qualify for dependent care through an FSA is 13.

. For dependent care FSAs you may contribute up to the IRS maximum limit unless your employer has set a lower limit. If you have one child and spent over 8000 for their care in 2021 you can still take advantage of 3000 of expenses 8000 childcare expense limit minus the 5000 of expenses you have already. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycare.

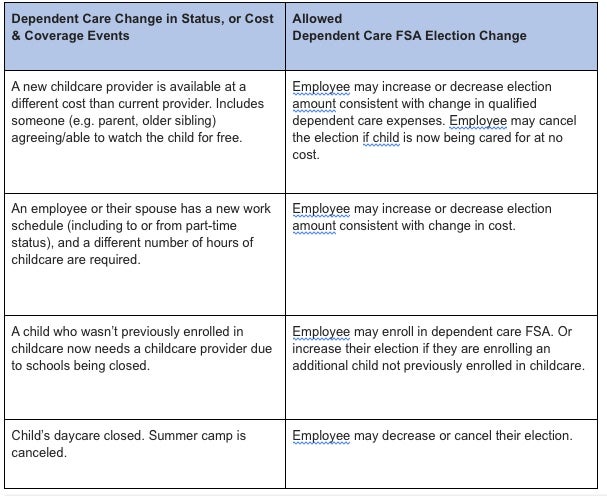

The American Rescue Plan Act of 2021 ARPA signed into law on March 11 2021 permits employers to increase the annual limit on contributions to Dependent Care Flexible Spending Accounts. The new Dependent Care Flexible Spending Account annual limits have increased to. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday.

The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for. If a child turned 13 in the 2020 plan year AND the participant rolled over funds into. How much can I contribute to my dependent care FSA.

Dependent Care Fsa Increase To 10500 Annual Limit For 2021 June 17 2021 On March 11 2021 The American Rescue Plan Act Of 2021. Note that these changes are temporary and are a response to the enormous changes and challenges that came along with the pandemic. For more information on these changes and how these changes may affect you.

The employee incurs 15500 in dependent care expenses in 2021 and is reimbursed 15500 by the DC FSA. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. The Savings Power of This FSA.

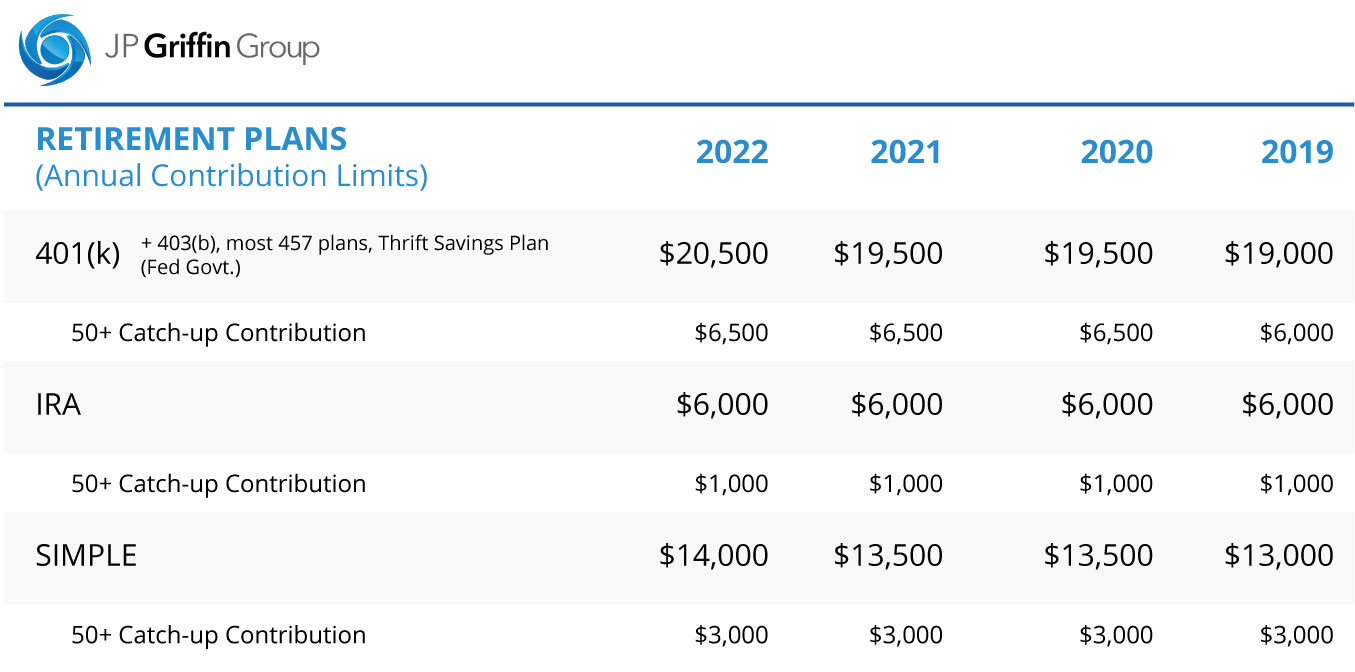

The 2022 dependent care contribution limits are as follows. Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit. This is an increase of 100 from the 2021 contribution limits.

WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable. The IRS limits the total amount of money you can contribute to a dependent-care FSA. 5000 for single taxpayers and married couples filing jointly.

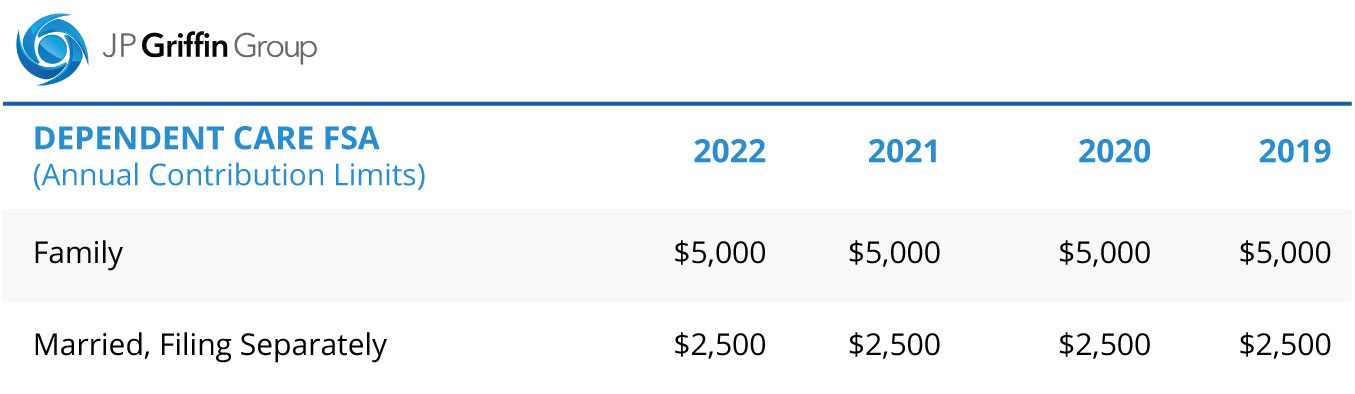

2500 for married individuals filing separately. IRS contribution limits are 5000 per year if you are married and filing a joint return or if you are a single parent. Employers may allow participants to carry over unused amounts IR-2021-40 February 18 2021 WASHINGTON The Internal Revenue Service today provided greater flexibility due to the pandemic to employee benefit plans offering health flexible spending arrangements FSAs or dependent care assistance programs.

Contributions are not loaded upfront. It remains at 5000 per household or 2500 if married filing separately. 2021 Dependent Care FSA limit increase.

The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. If you are married and filing separately you may. The carryover limit is 550 for the 2021 income year IRS Revenue.

A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible. 214 of the Taxpayer Certainty Disaster Tax Relief Act. Eligible dependents must be children under age 13 or an adult dependent incapable of self care.

On March 11 2021 Congress passed the American Rescue Plan Act ARPA which raised the pretax contribution limits for Dependent Care Flexible Spending Accounts for calendar year 2021. However due to COVID-19 the age limit was bumped to age 14 in 2021 for any unused 2020 money. Single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500.

Thanks to the american rescue plan act single and joint filers could contribute up to 10500 into a dependent care fsa in 2021 and married couples filing separately could contribute 5250 up from 2500. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC.

Dependent care FSA increase to 10500 annual limit for 2021. The minimum annual election for each FSA remains unchanged at 100. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022.

Its a smart simple way to save money while taking care of your loved ones so that you can continue to work. The guidance also illustrates the interaction of this standard with the one-year increase in the.

What Are The Benefits Of Having A Section 125 Premium Only Plan Employers Paying Premiums Through A Premium Only Pla How To Plan Free Quotes Insurance Premium

Dependent Care Fsa Outdoor Activities For Kids Free Things To Do Kids Pictures

Dependent Care Assistance Program Optum Financial

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Explore Our Sample Of Child Care Expense Receipt Template Receipt Template Child Care Services Receipt

Dependent Care Fsa Dcfsa Optum Financial

Irs Releases Guidance On Taxation Of Dependent Care Benefits Subject To Extended Carryover Or Grace Period

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

What Is A Dependent Care Fsa Wex Inc

Dependent Care Fsa Outdoor Activities For Kids Free Things To Do Kids Pictures

What Is A Dependent Care Fsa Wex Inc

Year End Health Care Fsa Reminders Hub

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Dependent Care Fsa Outdoor Activities For Kids Free Things To Do Kids Pictures

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

![]()

Covid Relief 2021 Implementing Fsa Rule Changes On Vimeo

Beton Pour Plan De Travail Cuisine Plan De Travail Cuisine Plan De Travail Cuisine